College Budget Process

Managing a college’s finances is an essential function that first ensures students receive the education and support they need, while also sustaining faculty and staff, maintaining technology and facilities and strengthening the institution’s overall mission.

In a college or university setting, the General Fund is the institution’s main operating account. It’s where most unrestricted money is collected and from which most day-to-day expenses are paid.

The General Fund budget process requires a systematic approach to planning, allocating and monitoring the use of financial resources. Understanding this process is vital for administrators, faculty and staff who are involved in financial decision-making and strategic planning. This cycle generally consists of several distinct phases: planning, development, approval, and implementation. Each phase includes specific tasks and involves collaboration among various departments and stakeholders.

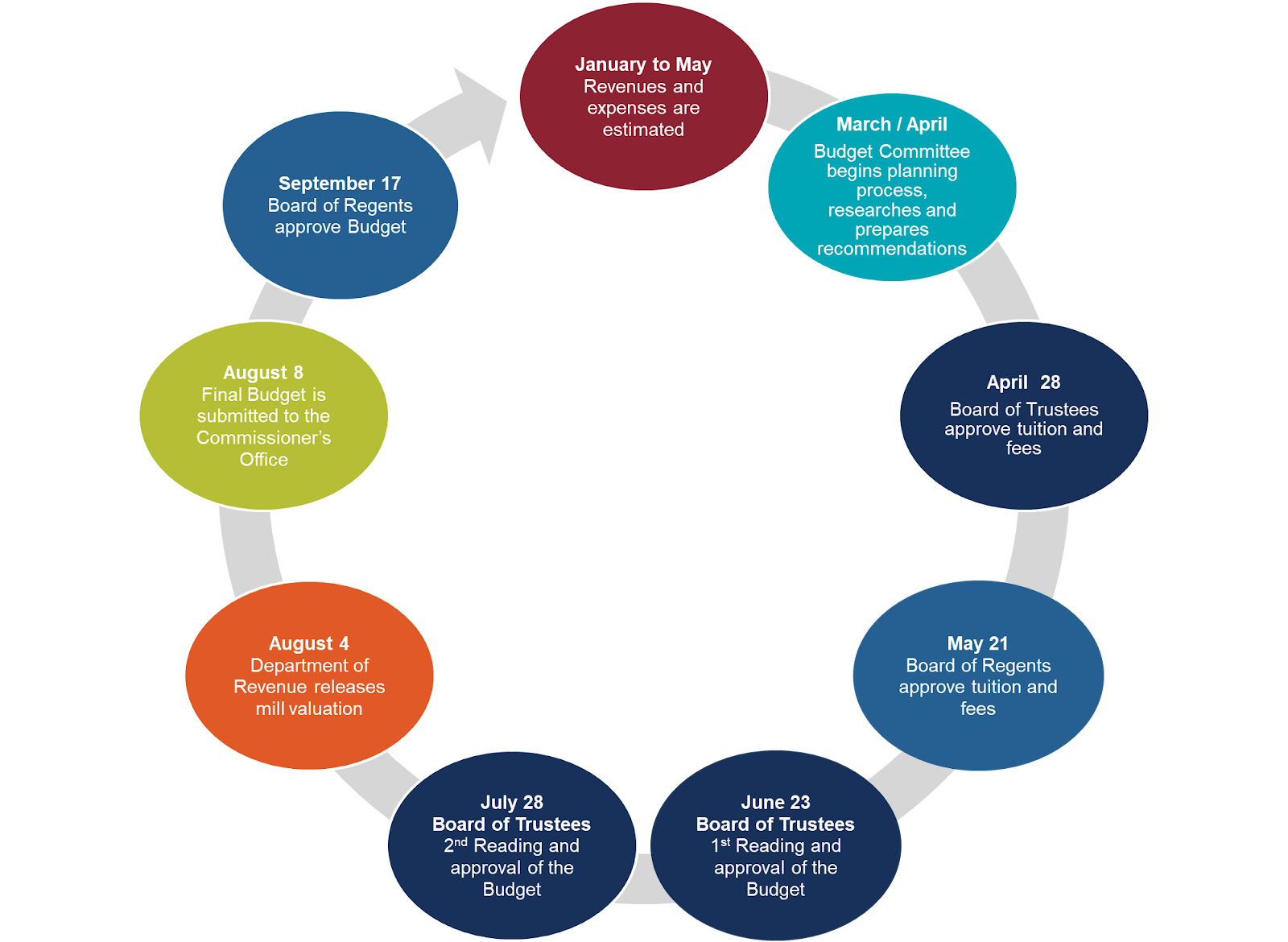

Overview of the annual college budget cycle:

Phase 1: Planning and Development

This phase begins several months before a new fiscal year. During this time, the college sets its goals and identifies financial priorities. Budget proposals are then drafted based on revenue forecasts and projected expenditure needs.

The Budget Committee reviews a tuition and mandatory fee proposal from administration. The Budget Committee is responsible to review the proposal, which is then communicated in an open student forum. Feedback for the Tuition and Fees proposal is communicated to the President to review and make a formal recommendation to the Board of Trustees for approval at the April meeting. Final Tuition and Fee proposal is approved by the Montana State University System Board of Regents at the May meeting.

Phase 2: Approval

The budget is drafted and reviewed for adjustments in a series of meetings. These proposals must be approved by senior leadership and governing boards, including the Board of Trustees and the Board of Regents.

Phase 3: Implementation and Monitoring

After receiving approval, the budget is implemented and serves as the institution's financial roadmap. The budget is continuously monitored and evaluated throughout the year to ensure financial integrity and to allow for adjustments as needed. For example, if a significant event like an unexpected decline in enrollment occurs and impacts revenue projections, budget adjustments may be necessary.

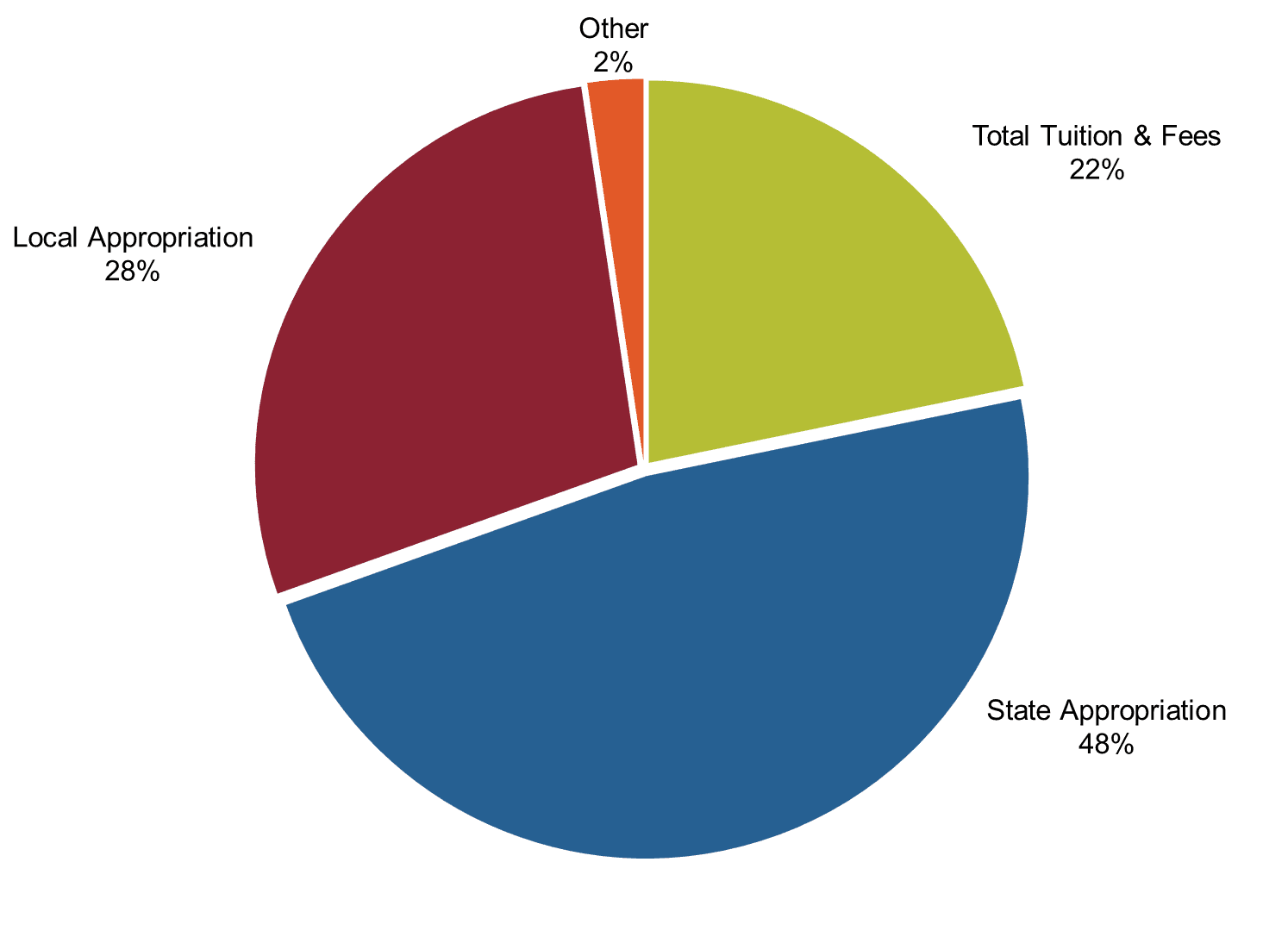

How We Fund the College

The college budget process typically begins with the development of revenue forecasts, which project the amount of money the college expects to receive from various sources. These revenue streams are the financial backbone of the institution, ensuring we can support our students, faculty, and staff, and maintain our facilities and technology.

One of the primary sources of revenue is tuition, charged per credit based on residency. See Tuition & Fee information for current rates. Mandatory fees are assessed to all students regardless of their academic program and cannot be waived.

The Montana Legislature provides state funds to the Montana University System, which are then distributed to individual colleges. The university system’s operating budget requires approval from the Board of Regents by October 1 of each fiscal year.

Montana’s community colleges are required to have a local levy under state law (MCA § 20-15-314). This law allows the governing body of a community college service region to impose a tax on real and personal property to help finance the college’s services, supplementing state appropriations and other revenue sources. Additional permissive levy may also be used by Montana counties to provide health insurance for employees (MCA § 2-9-212).

Average distribution of revenue, shown as percentages across key categories:

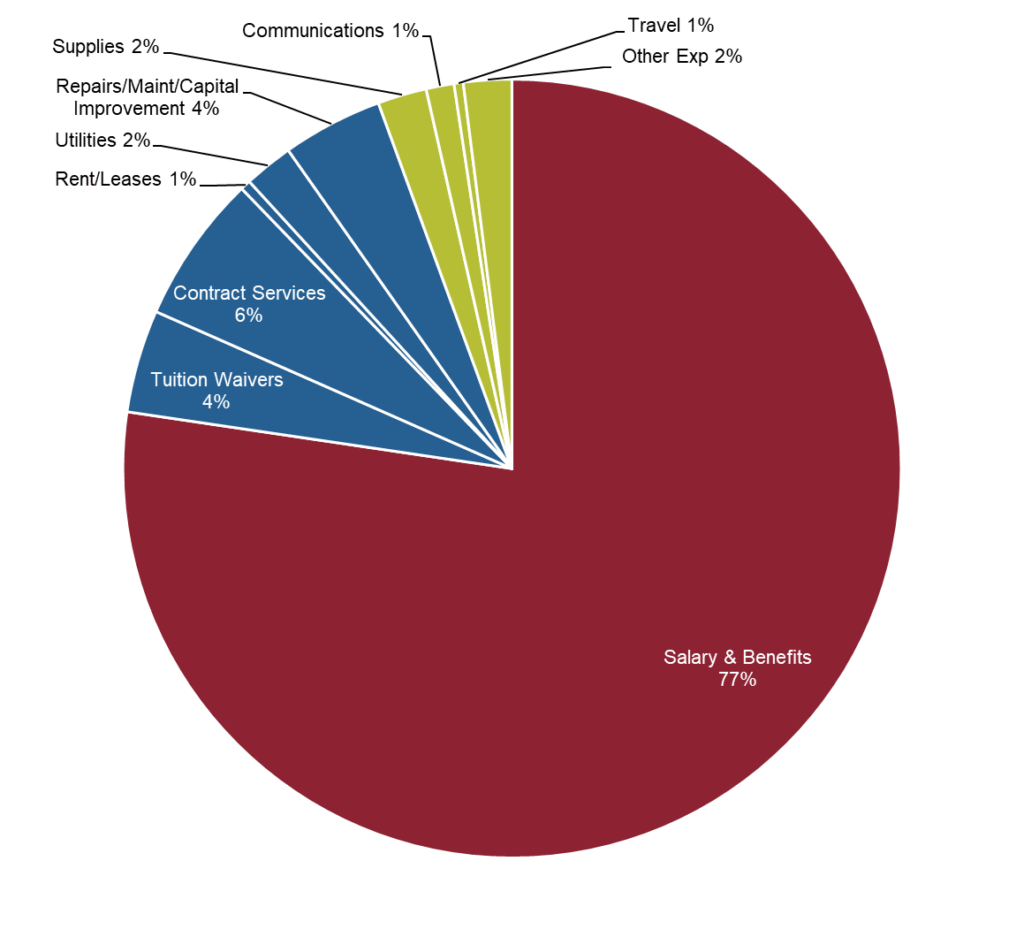

How we allocate resources

The college uses an incremental budgeting approach to review expenses. This process starts with the previous year’s budget as a baseline. Instead of applying across-the-board increases, available funds are evaluated and allocated based on demonstrated needs and priorities. Adjustments may be made for factors like inflation, anticipated cost changes, or shifts in operational needs. This method provides continuity from year to year while directing resources to support the college's mission and strategic goals.

Departmental Input

At the start of the calendar year, Department Chairs and Directors can propose budget changes and communicate specific needs. This ensures resources are aligned with program priorities and operational requirements.

Budget Composition

Although the college's budget may appear large, on a five-year average from FY2021 to FY2025, 77% of its resources are allocated to salaries and benefits. Of the remaining 23%, 17% is committed to mandatory or previously designated expenditures and cannot be used for one-time or discretionary purposes, leaving only 6% as truly unallocated and optional in the budgeting process. It is important to note that a departmental General Fund budget represents just one part of overall funding. Instructional departments also plan for program expenses using Lab Fee budgets and other restricted accounts; however, expenditures from these sources are not included in the General Fund and must be considered separately to get a complete picture of available program resources.

An additional source of program resources comes from allocated equipment fees collected. The Equipment Fee is a mandatory student fee. The funds are managed by a faculty committee, which reviews applications, prioritizes requests, and allocates funds to support instructional needs. The committee meets each fall and spring semester to ensure that resources are directed toward equipment and other expenses that enhance teaching and learning.

A combination of revenue projections and expense resource allocations is developed to generate the proposed college budget, which is then presented to the Board of Trustees for review and consideration and June and July meetings.

Budget Oversight and Transparency

At the start of each fiscal year, Flathead Valley Community College provides reports to the Commissioner of Higher Education (OCHE) and the Board of Regents (BOR) to review operating budgets and evaluate expenses. To view recent reports, please visit the Operating Budgets page of the Montana University System website.

The college files an audited financial report with the Montana State Legislative Audit Division to support its mission of increasing public trust in state government.

Lab / Course fees are assessed to cover the unique or extraordinary costs associated with the delivery of a specific course. Appropriate uses of course fees are limited to the following:

- Specialized activities or equipment fees, where payment is made to individuals or entities generally conducting these types of activities (such as downhill skiing, bowling, etc.).

- Field trips.

- Study abroad programs.

- Pass-through fees (such as Red Cross certifications, Nursing liability insurance, etc.).

- Laboratory consumables and other class consumables (such as sheet music), excluding computer supplies and paper products.

- Materials used by students to create a product that becomes the student’s property after use in a specific course.

Mandatory Fees assessed to all students registering at the campuses, regardless of the academic program or course of study chosen by the student. Mandatory Fees 940.3

- Activity: administered by Student Government to support programs, services and activities for FVCC students.

- Infrastructure: maintain and improve existing facilities, campus grounds and parking areas, to construct facilities, and to purchase new land or buildings.

- Equipment: maintaining and updating campus equipment.

- Technology: purchasing or leasing computer equipment, software, maintenance or related items which benefit campus programs.

- Health: maintain and operate the Student Health Clinic for students enrolled in six or more credits.